FAQS

Q.1 What is the mission of Baruk Capital Partners?

Ans. Baruk Capital Partners is a deal provider specialist with expertise in fast-growing frontier markets, a team of highly experienced and skilled professionals and numerous business developers across Africa.

Q.2 What does a private equity investor do?

Ans. Private-equity firms (« PE ») are formed by investors who want to directly invest in other companies, rather than buying stock. They usually buy the whole company.

Investors in private equity funds include some of the nation’s largest pension funds and endowments, as well as individual wealthy investors.

Q.3 How long does the fundraising process take?

Ans. The length of time required to raise funds through our network of investors will be dependent on the business and its investment readiness.

Typically our pre-screening and due diligence process takes between 1-2 weeks, and the whole process will run for somewhere between 6 and 12 months, more likely more for infrastructure projects.

Q.4 What fees will you charge me for raising capital or debt?

Ans. We only charge companies a success fee. The success fee will be a percentage of the gross amount raised and will be payable on the financial closing date.

Q.5 What sectors does investors focus on?

Ans. We will consider a wide range of sectors, although typically we will provide investors with sustainable investment opportunities that deliver high returns to your doorstep in the consumer-driven sectors, infrastructure, financial services, construction and real estate.

Q.6 What are your company selection criteria?

Ans. We look for companies that can demonstrate, strong financial and operational track record, experienced local management and adherence to good corporate governance practices, Strong growth prospects based on realistic assumptions and realistic exit strategy.

Q.7 What is your due diligence process?

Ans. We are very selective; many more of companies are rejected during our pre-analysis process.

Our team of analysts works with independent legal experts to carry out due diligence on every company and the people behind it.

We do our homework, and we’ll only source financing for companies that have met our due diligence standards.

Q.8 Is there a minimum or maximum amount I can raise?

Ans. We typically work with companies that are looking to raise at least US5 million up to US1 billion can be more.

Q.9 How do I apply to raise money for my business?

Ans. Please email us at contact@barukcapital.com with details of your business (Teaser, business plan…). One of our analysts will then be in contact to discuss matters further.

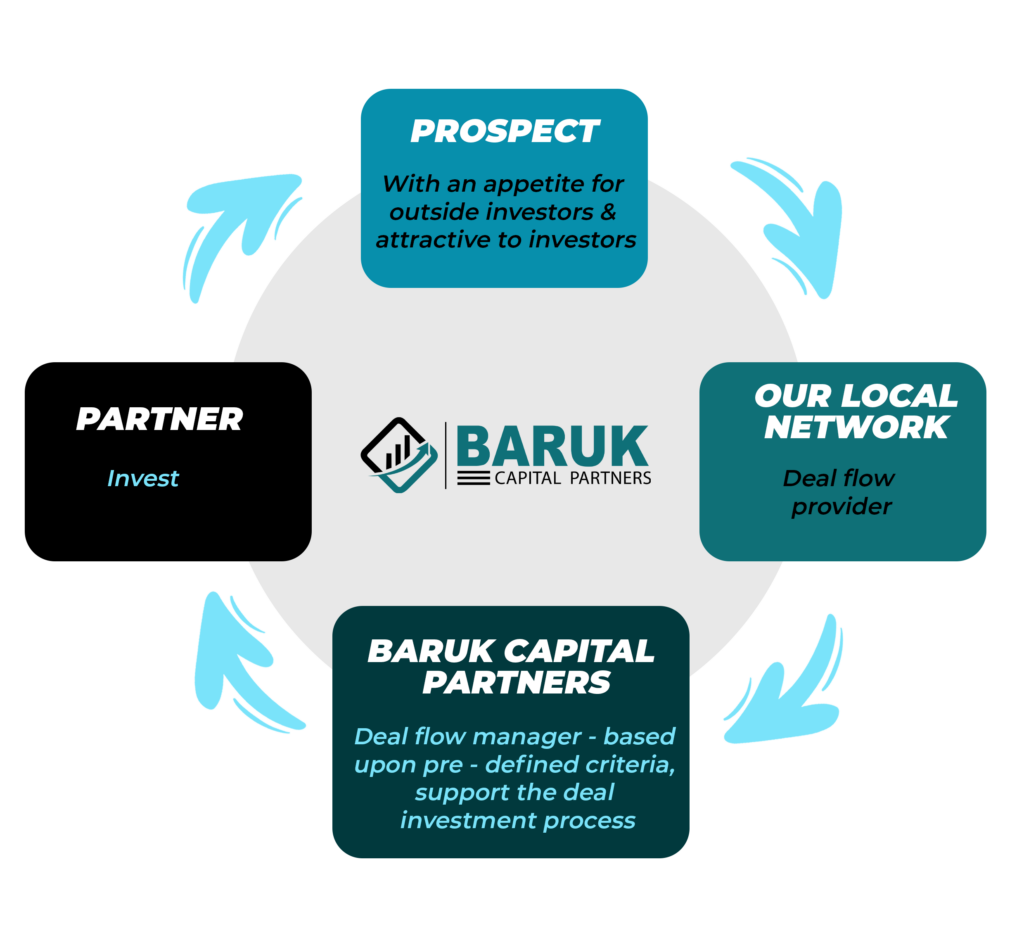

Q.10 How Baruk Capital Partners source its projects?

Ans.

We will use our extensive network of contacts in industry, finance, government, and development finance institutions, as well as direct outreach to potential investors.

Our market intelligence combined to our rigorous top-down pre-analysis reduces the complexities associated with sourcing bankable projects in Africa.

Our deal origination cycle

BARUK CAPITAL PARTNERS

READY TO GO THE EXTRA MILE FOR YOUR COMPANY?